Banking operations that earlier required a person to visit the bank have been replaced by new technology that allows banking operations to be carried out from anywhere using electronic devices.

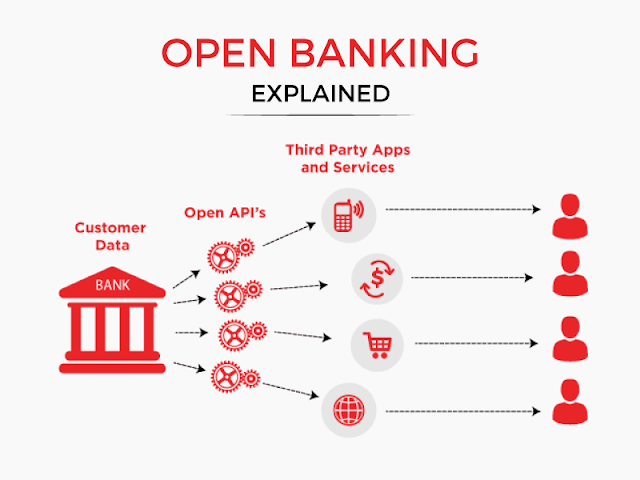

The rise of open banking has revolutionized the financial

services industry by establishing state-of-the-art to manage finances. It

describes the process of banks and other financial institutions permitting

customers to share and control their financial data with trusted open

banking providers with the use of open banking APIs.

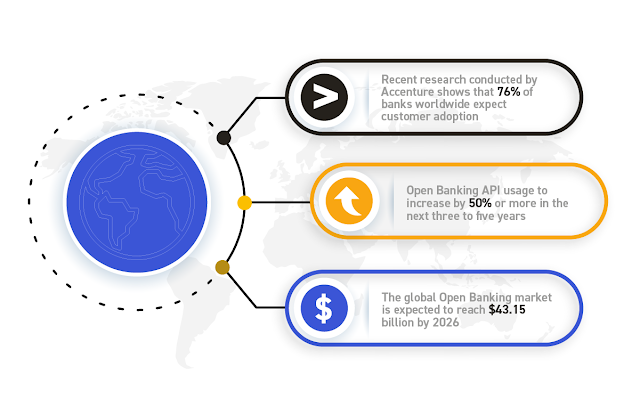

Open banking is accepted globally where more than 87% of countries have established some form of Open APIs in the banking industry. The global open banking market is expected to grow $37.77 billion in 2025 at a CAGR of 25.7%. Allied Market Research says, the open banking market size to expected to reach $43.15 billion by 2026, growing at a CAGR of 24.4% from 2019 to 2026.

The era of digitalization has characterized financial

services in 3 words: swift, easy and flawless. Let’s see how open banking

technology is changing the FinTech industry and provides unique opportunities

to banks, customers and financial institutions.

What is Open Banking Technology All About?

Open Banking is a systematically designed model which allows licensed third-party providers (TPPs) to access customers’ financial or banking data using application programming interfaces (APIs). The bank shares this banking data only with the consent of the customers. Open banking API providers gives control to the customer to select what type of financial data TPP can access and for how much time. Open banking technology enables direct banking transactions between businesses and customers by making cross-platform payment APIs.

What is Open Banking Called Globally?

Open Banking is a generic term that is used to set the regulations and initiatives worldwide. Different countries have different names for their open banking systems.

What is the impact of open banking on the financial industry?

The economist suggests that adopting open banking could help banks to influence

According to the Economist research, they suggested that espousing open banking technology could help banks to control their internal data. As per the survey conducted, 45% of respondents have started to transform their current business models into digital ecosystems, and 29% of respondents mentioned that open banking is a part of a bank’s innovation strategy.

Any FinTech solution company or bank can use open banking

technology to create new products and enhance customer relationships.

Who is benefited from Open Banking Providers?

Benefits to Customers

Open Banking to customers comes up with multifarious benefits and one of the most important benefits is to provide choice to customers. Generally, banks give only limited options and similar types of services to all the customers. Open banking provides the benefit of choice to customers as they have the freedom to choose from different service providers available. It also permits customers to take their financial decisions and manage their banking accounts.

- Facilitation payments using electronic devices

- Easy Payment and Currency Exchange

- Customized Product

Benefits to Banks and Financial Institutions

- Collective Advantage

- Banks can be futuristic

- Boost the Customer Engagement

Open Banking APIs providers assist banks in boosting

their appeal as an entity thereby permitting them to fulfil the changing

demands of both new as well as existing customers.

When banks and fintech merge and use open-source technology, they can offer customers a complete service or product that will help to upsurge customer satisfaction, the loyalty of customers, and increase revenue.

Benefits to FinTech

- An opportunity to meet customer expectations

- Banks can extend their services using new technology

In this cut-throat competition in the banking industry,

banks look for the best digital technology to serve the best to their

customers.

Banks can offer the best opportunity to their customers using open banking providers which can give the best customer engagement and retention.

Benefits of Open Banking Technology

Open Banking has the potential to reinvigorate the banking sector with some benefits for both customers as well as bank owners. Let’s understand the benefits of open banking.

- Effortless Payments

Open banking payment services allow customers to effortlessly make direct and flawless payments using their bank account without mentioning their card details. Customers just need to make a few steps of authentication and then confirm the payment through a banking application or website.

- New-fangled services and products

- Culture Modernization

Open banking inspires banks to elevate their digital infrastructure so that they can share customers’ data with utmost security. Modern payment technology aids banks to improve their data structure and digitalization.

- Upsurge in the financial market

Are there any risks of online banking?

- Interpersonal relationship with customer reduces

- Trustworthiness of customers

- FinTech replaces Traditional ways of banking

Growth of open banking globally in near future

In the past few years, the usage of Fintech has been

accelerated with an increasing number of businesses adopting this vigorous

technology that allows them to offer the best services.

However, there is a scope of growth and prosperity with open banking that can carry potential change in the way of banking.

The UK is one of the leading countries in the open banking sector. In the UK 294 regulated providers of open banking are available (215 TPP and 79 account providers), as per the December 2020 update of open banking. Moreover, till January 2021, more than 2.5 million customers have used products enabled with open banking. According to PWC Research, 64% of adults will be adopting open banking by 2022.

The European market started using open banking APIs after 12 to 18 months it started in the UK. Research from Tink showed that 58% of European FinTech decision-makers still see open banking as an opportunity.

In 2016, Unified Payments Interface (UPI) was launched in India. UPI allows customers to access banking accounts using registered applications and can make transactions to other banks. India is having a hybrid approach to open banking which is partly driven by the market and partly by regulations.

Open banking is still developing globally, some countries are accepting open banking technology rapidly whereas some are lagging behind. Over 70,000 businesses are using the GoCardless facility so that customers can easily make digital payments and can perform various banking transactions.Last Words on Open Banking Technology

Open banking is the future for all banks and fintech

businesses. Globally there is an increase in competition and the development of

new products and services is possible when more and more banks and financial

businesses are accepting and connecting with open banking technology.

The financial sector is changing its traditional structure of banking operations by adapting new technologies of open banking. The evolution in fintech is going to be a remarkable thing that will help customers to perform hassle-free banking transactions from anywhere in the world. Open banking plays a significant role in the future of banking and financial businesses.

Traditional banking won’t get absolute by open banking. With the growth of open banking, there will be more competition for tech giants, banking sectors and financial institutions.

Comments

Post a Comment